By Богл Д.

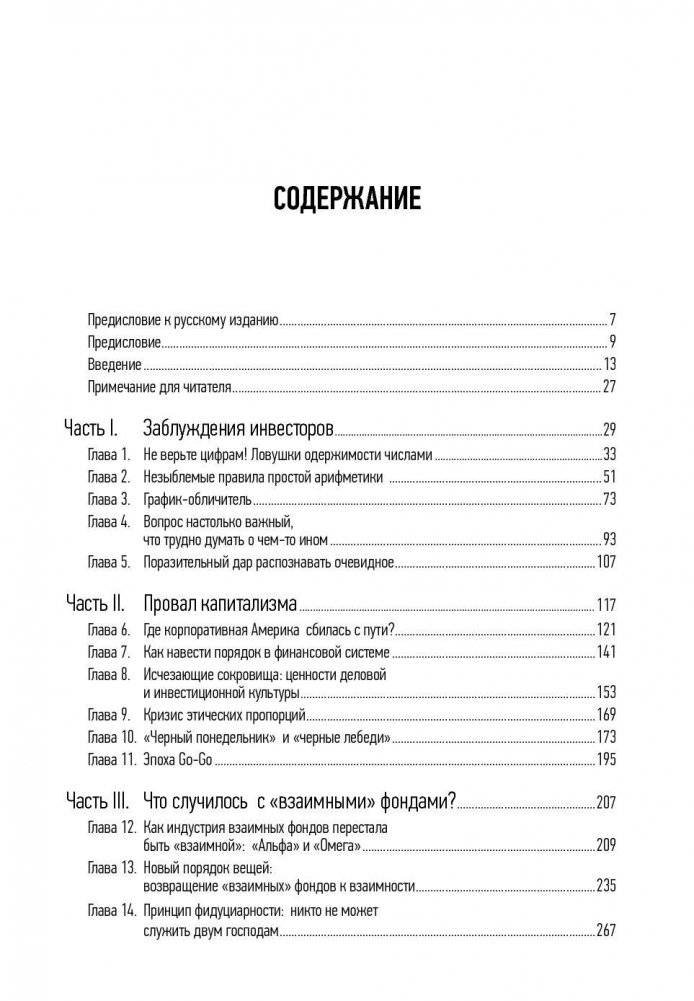

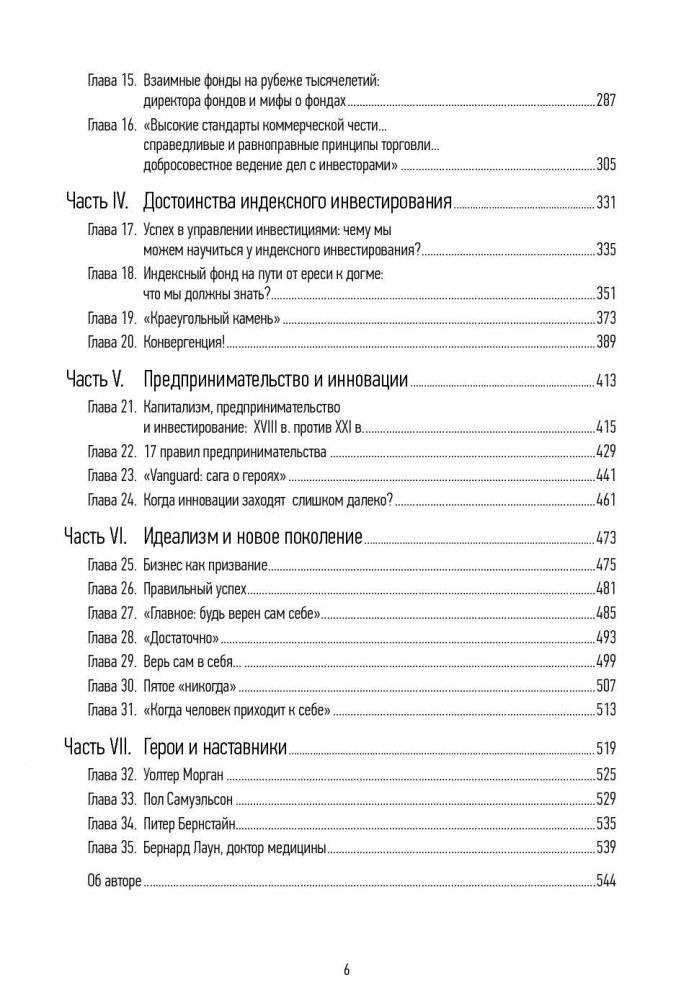

«Не верьте цифрам!» — книга легендарного финансиста Джона Богла, которого называют отцом индексного инвестирования, представляет собой антологию последних статей и выступлений на темы, больше всего волнующие автора: непомерная стоимость услуг финансовых посредников; постыдное несоблюдение компаниями своих фидуциарных обязательств; удручающее торжество эмоций над трезвым разумом в очень многих инвестиционных решениях и как результат — победа спекуляций над инвестированием. Основная идея, которую автор пронес через всю книгу и через свою долгую жизнь, до гениальности проста: бессмысленно пытаться обыграть рынок, добиваясь больших доходностей, — напротив, нужно сотрудничать с ним и чутко улавливать любые его движения. Только в этом случае взаимные фонды будут по-настоящему «взаимными».

<hr>Delve into the insightful world of legendary financier John Bogle, the "father of index investing," with "Don't Trust the Numbers." This anthology of Bogle's final articles and speeches tackles the issues closest to his heart, offering timeless wisdom for investors of all levels.

Bogle fearlessly addresses the excessive costs of financial intermediaries, the shameful disregard of fiduciary responsibilities by companies, and the disheartening triumph of emotions over reason in investment decisions. He argues that speculation often overshadows genuine investing, leading to suboptimal outcomes for many.

The core principle that Bogle champions throughout his life and this book is remarkably simple: it's futile to try and beat the market by chasing higher returns. Instead, investors should collaborate with the market, keenly observing its movements. Only then can mutual funds truly live up to their name and serve the interests of their investors.

This book is ideal for:

The reading level is accessible to anyone with a basic understanding of financial concepts. Bogle's clear and concise writing style makes complex ideas easy to grasp.

In a world of fleeting trends and complex financial products, "Don't Trust the Numbers" offers a refreshing dose of common sense. John Bogle's unwavering commitment to investor interests shines through every page, providing readers with the knowledge and confidence to make informed decisions and achieve their financial goals. This book is a must-read for anyone seeking to navigate the complexities of the modern investment landscape and build a secure financial future.