Options, Futures, and Other Derivatives: Your Comprehensive Guide

Unlock the world of derivatives with this definitive guide, a trusted resource for professionals and a favorite textbook for students. This extensively revised and updated edition provides a thorough understanding of options, futures, and other derivative instruments, equipping you with the knowledge and skills to navigate the complexities of modern financial markets.

What You'll Learn:

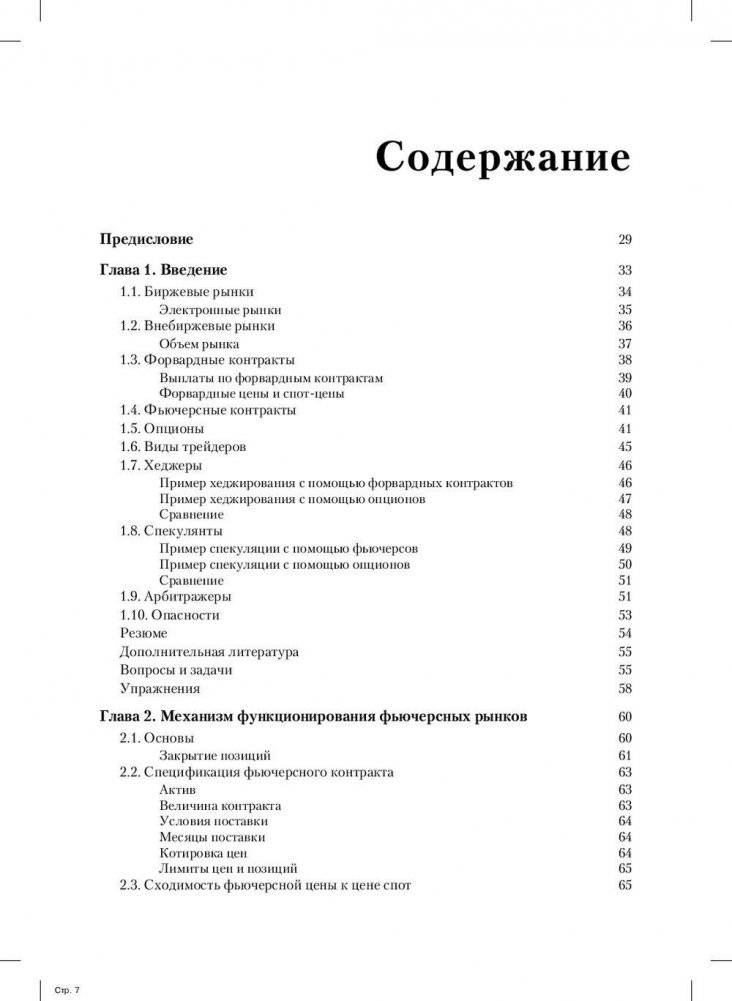

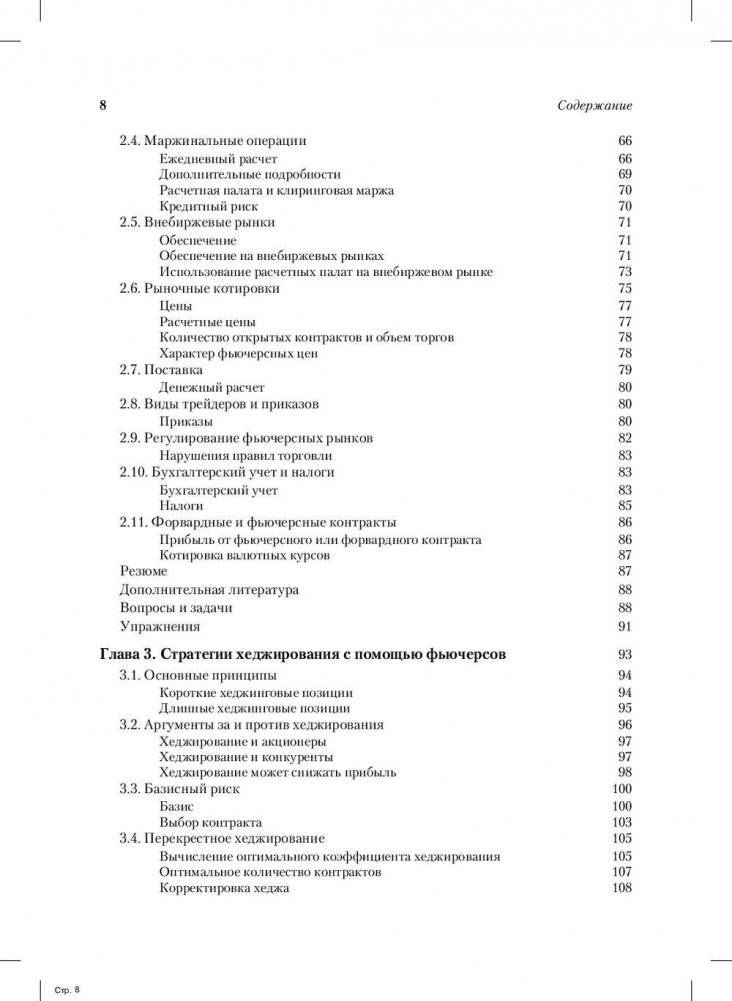

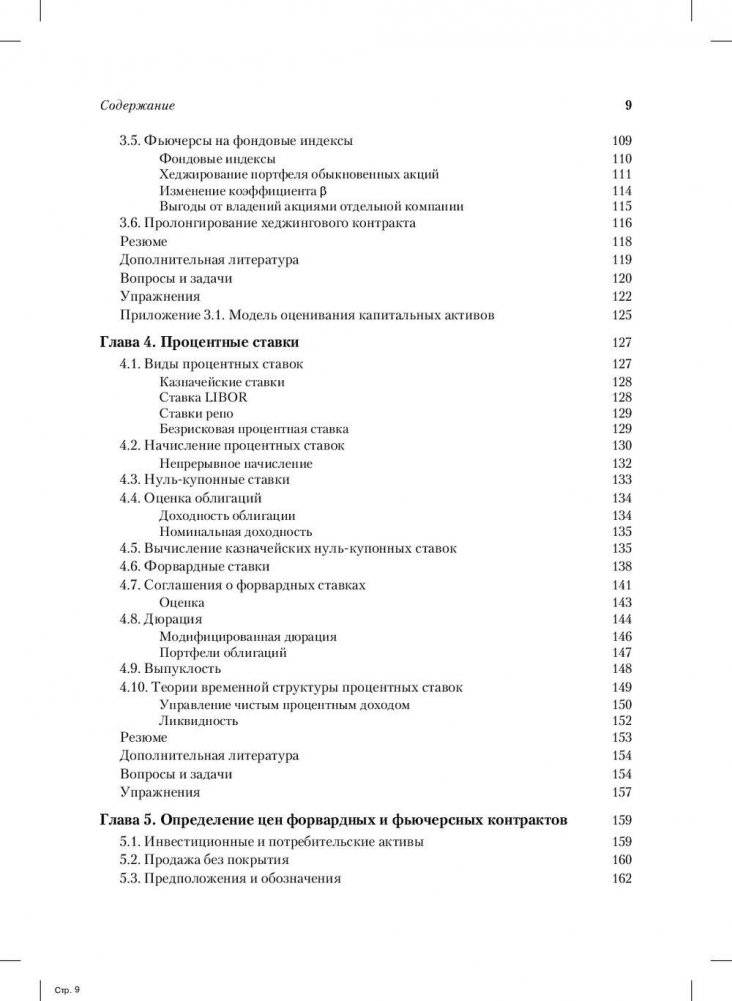

- Comprehensive Coverage: Explore a wide range of derivative instruments, from basic options and futures to more complex structures.

- Real-World Applications: Gain practical insights through real-world examples and case studies, demonstrating how derivatives are used in risk management, hedging, and speculation.

- Up-to-Date Information: Stay current with the latest developments in the field, including discussions on central clearing, liquidity risk, and overnight indexed swaps.

- Credit Derivatives: Understand the intricacies of credit derivatives and their role in the financial system.

- Energy and Commodity Derivatives: Delve into the specifics of energy and other commodity derivatives markets.

- Advanced Modeling Techniques: Master advanced modeling techniques, including an alternative derivation of the Black-Scholes-Merton formula using binomial trees.

- Risk Management: Learn how to calculate Value at Risk (VaR) using real-world data.

- Structured Products: Explore innovative structured products such as principal-protected notes, gap options, cliquet options, and jump processes.

- Interest Rate Models: Understand and apply the Vasicek and CIR interest rate models.

Key Features and Benefits:

- New Chapter on Securitization and the 2007 Credit Crisis: Gain valuable insights into the causes and consequences of the financial crisis.

- DerivaGem Software Included: Access the widely acclaimed DerivaGem software (version 2.01) with numerous enhancements, including credit derivative coverage and open-source code for functions. Compatible with Open Office for Mac and Linux users.

- Clear and Concise Explanations: Benefit from clear and concise explanations of complex concepts, making this book accessible to readers with varying levels of experience.

- Practical Examples and Exercises: Reinforce your understanding with practical examples and exercises that challenge you to apply what you've learned.

Who Should Read This Book?

This book is ideal for:

- Finance Professionals: Risk managers, traders, portfolio managers, and other finance professionals who need a comprehensive understanding of derivatives.

- Students: Undergraduate and graduate students in finance, economics, and related fields.

- Anyone Interested in Financial Markets: Individuals who want to learn more about the role of derivatives in the global economy.

Why Choose This Book?

This book is more than just a textbook; it's a comprehensive resource that will help you master the world of derivatives. With its clear explanations, real-world examples, and up-to-date information, this book is an essential tool for anyone who wants to succeed in today's complex financial markets. Don't just learn about derivatives – understand them. Order your copy today!